Acacia has agreed to increase its ownership from 51% to 100% in the two licences covering the majority of West Kenya project area from a subsidiary of Lonmin plc (“Lonmin”) for consideration of US$5 million. Following the completion of the agreement Acacia has full exposure to an exciting and highly prospective land package in Kenya, including our most advanced project, the Liranda Corridor. Acacia continues to intersect high grade gold zones at the Bushiangala and Acacia prospects along the Liranda Corridor where drilling is indicating the potential for a new gold camp.

Commenting on the progress, Brad Gordon CEO of Acacia, said:

“We are greatly encouraged by our continued exploration success in Kenya. Our systematic approach to exploration and drill targeting, as well as taking the decision to drill deeper holes early has resulted in the potential for an exciting new discovery. As a result we have moved to consolidate our position in the project at this stage to ensure our shareholders will be able to fully benefit if the project continues to progress. ”

Update on the Liranda Corridor

As disclosed in our 2016 Interim Results on the 22nd July, Acacia has continued to drill test prospects within the Liranda Corridor, located in the northeast of the licence area. We are approximately 30% of the way through a 40,000 metre drilling programme to test the structural orientation and continuity of high grade gold mineralisation encountered on the Acacia and Bushiangala Prospects. The programme, if successful, aims to allow for the calculation of an initial inferred resource by early 2017. Previously released (22nd July 2016) assay results from 11 diamond core drill holes drilled in H1 2016 testing the Acacia and Bushiangala prospects, two of at least six potential gold prospects in the corridor, continued to return positive results from multiple mineralised structural zones including:

Acacia Prospect:

- LCD0073: 1.0m @ 7.00 g/t Au from 489m

- LCD0074: 1.4 m @ 5.40 g/t Au from 327m

- LCD0076: 5.8m @ 24.9 g/t Au from 334m

- LCD0077: 2.5m @ 25.0g/t Au from 412m

- LCD0079: 1.5m @ 13.3g/t Au from 31m,

- 3.0m @ 125g/t Au from 37m, and

- 4.0m @ 55.5 g/t Au from 349m

Bushiangala Prospect:

- LCD0075: 2.5m @ 7.77g/t Au from 214m,

- 2.8m @ 11.1g/t Au from 250m, and

- 12.8m @ 15.3g/t Au from 274m.

- LCD0078: 4.3m @ 6.48g/t Au from 105m, and

- 2.3m @ 17.3g/t Au from 226m.

Note: quoted intersections are down-hole widths. Drill hole directions for individual drill holes vary with the recent changes in the interpretation of mineralisation and the true thickness of mineralised structural zones are currently being reviewed with modelling of mineralisation. Acacia’s current interpretation considers these structural zones to be between 2 metres and 6 metres true width.

Following the update in July, assays from hole LCD0082, drilling on the Acacia prospect were received and contained the below significant assay results:

- LCD0082: 4m @ 15.6g/t Au from 423m

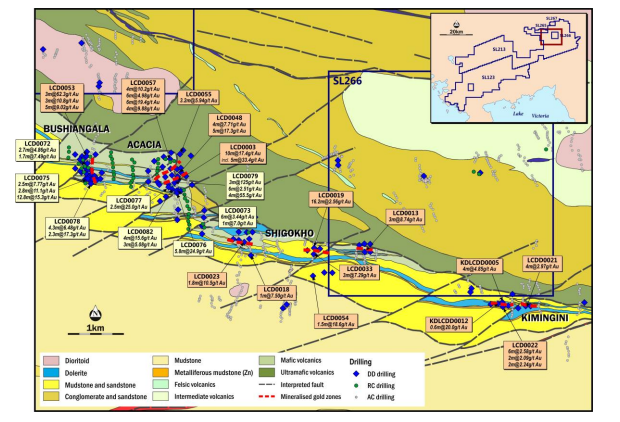

Figure 1 – Location of Liranda Corridor shown on inset; image shows current geological interpretation for Liranda Corridor,

interpreted surface trace of gold zones and the location of diamond core holes drilled by Acacia in 2015-2016 with selected

significant intersections. Bushiangala and Acacia prospects are located on left side of image.

The diamond core drill results to date are very encouraging indicating that mineralisation on both the Acacia and Bushiangala prospects occurs as multiple structural zones that extend to at least 400 metres vertical and potentially much deeper (Figures 2, 2a & 2b). Drilling is continuing to delineate the strike extent of each structural zone at each prospect, with initial indications that the shoots extend over 300-500 metres. The orientations and geometry of the shoots is becoming clearer with additional diamond core drilling and has resulted in the change of drill direction to more accurately target the strike and dip of the structural zones. Step-out drilling will target 80m and 160m extensions to each structural zone with the aim to delineate an initial inferred resource by early 2017.

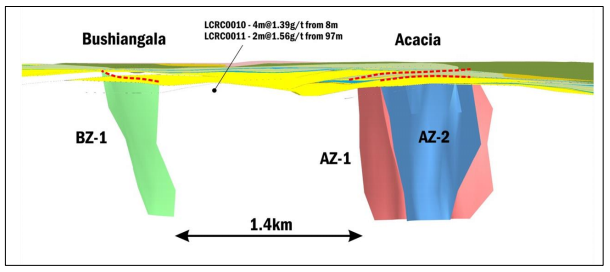

Figure 2 – Schematic representation of the Bushiangala BZ-1 zone and the Acacia AZ-1 and AZ-2 zones. To date mineralisation has been intersected to 500 metres on both shoots with further drilling required to identify higher grade shoots within these structural zones.

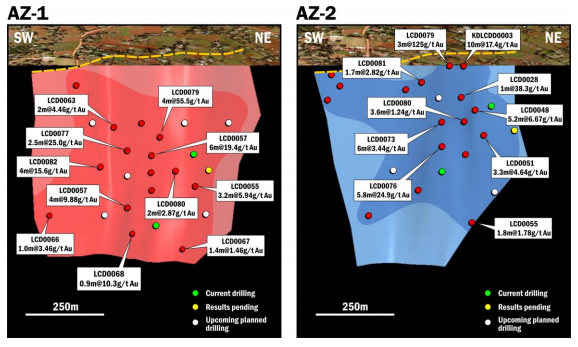

Figure 2a – schematic long sections of Acacia Structural Zones AZ-1 and AZ-2 showing interpreted pierce points and

highlighting more recent intercepts. The two structural zones are interpreted to strike between 050 and 060 degrees and dip steeply to the southeast, and are approximately 150 metres apart.

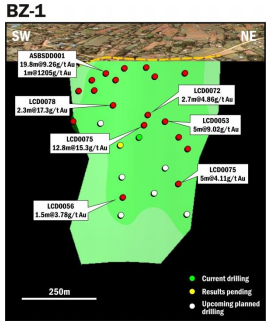

Figure 2b – Schematic long section of Bushiangala (BZ-1) showing interpreted pierce points and highlighting intercepts.

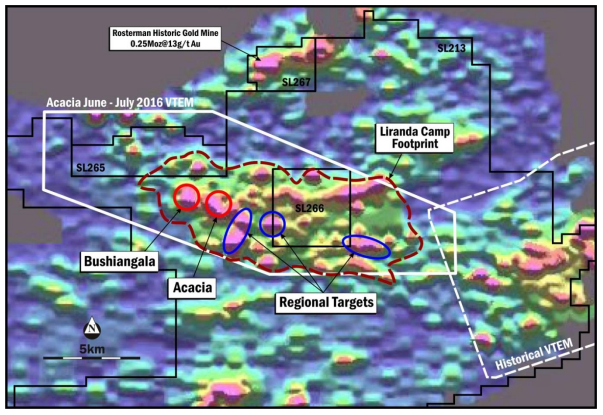

In addition to the diamond core drilling, we plan to undertake a 2,400 line kilometre VTEM survey on 50 metre line spacing in July 2016 across the extent of the Liranda Corridor to assist with our geological and structural understanding and to enhance drill targeting (Figure 3).

Figure 3 – Image of soil geochemistry for Liranda Corridor showing area of planned airborne VTEM survey and previous

VTEM survey – warmer colours indicate areas of gold anomalism

Background to the West Kenya Project

The West Kenya Project is made up of two joint ventures, the West Kenya Joint Venture and the Advance Gold Joint Venture. The West Kenya JV with Lonmin consists of two licences that covers the majority of the 1,650 square kilometre project area and is host to the Liranda Corridor, the most advanced exploration prospect. Prior to the agreement to accelerate the earn-in, Acacia owned 51% of the project, with Lonmin, through a subsidiary, AfriOre International (Barbados) Ltd (“AfriOre”), owning the remaining 49%. Acacia would increase its stake to 75% following the completion of a prefeasibility study showing a net present value (“NPV”) of at least US$50 million, and then to 100% through a cash payment equal to 17.5% of the pre-feasibility study NPV.

Following the payment of US$5 million, Acacia will increase its ownership in the project to 100%. The two licences covered by the joint venture are currently held in AfriOre’s name, the transfer of these licences into Acacia’s name requires the approval of the Kenyan Cabinet Secretary for Mining.

The Advance Gold Joint Venture is comprised of three licences that are excised from the Lonmin licence area. Acacia currently owns 85% of the joint venture, and is currently earning additional equity in the project with Advance Gold, the JV partner, electing not to contribute to the current exploration programmes. See the press release here.