Debt Settlement

The Company is pleased to announce that it has settled up to $1,500,000 in debt with arm’s length and non-arm’s length parties. Of this amount, $1,150,000 relates to the principal amount of unsecured debentures, carrying a 10% interest rate, which was settled by issuing an aggregate of 3,285,714 common shares priced at $0.35 per common share to arm’s length debt holders in full or partial settlement, as the case may be, of outstanding indebtedness. The balance of $350,000 of the indebtedness relates to the provision of management and director consulting services and fees for an aggregate of 875,000 common shares, priced at $0.40 per common share, which will be issued to the Company’s CEO and directors in full or partial settlement, as the case may be, of the outstanding indebtedness.

Pursuant to Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”), the debt settlement may be classified as a “related party transaction” as certain insiders of the Company have participated in the debt settlement. Accordingly, pursuant to MI 61-101, the debt settlement, in so far as it relates to the insiders, may be subject to the minority shareholder approval and the formal valuation requirements. The Company has determined that an exemption from the minority approval requirement of MI 61-101 is available under section 5.7(a) of MI 61-101, and that an exemption from the formal valuation requirement of MI 61-501 is available under section 5.5(a) of MI 61-101, because, in each case, neither the fair market value of the common shares to be issued in connection with, nor the fair market value of the consideration for, the debt settlement, insofar as it involves “interested parties” (as defined in MI 61-101), exceeds 25% of the market capitalization of the Company.

Having regard to these exemptions and the Company’s desire to settle outstanding debt as soon as possible, the Company believes that it is reasonable to close the issue of the common shares in connection with the debt settlement less than 21 days after the date of this news release.

The TSX-V has conditionally approved the issue of the common shares in connection with the debt settlement, subject, in the case of the Company’s CEO, to receiving disinterested shareholder approval at the upcoming annual and special meeting of the shareholders of the Company scheduled for August 5, 2016.

The common shares issued in connection with the debt settlement will be subject to a statutory four-month and one day hold period after the date of issue.

2016 Field Program Update

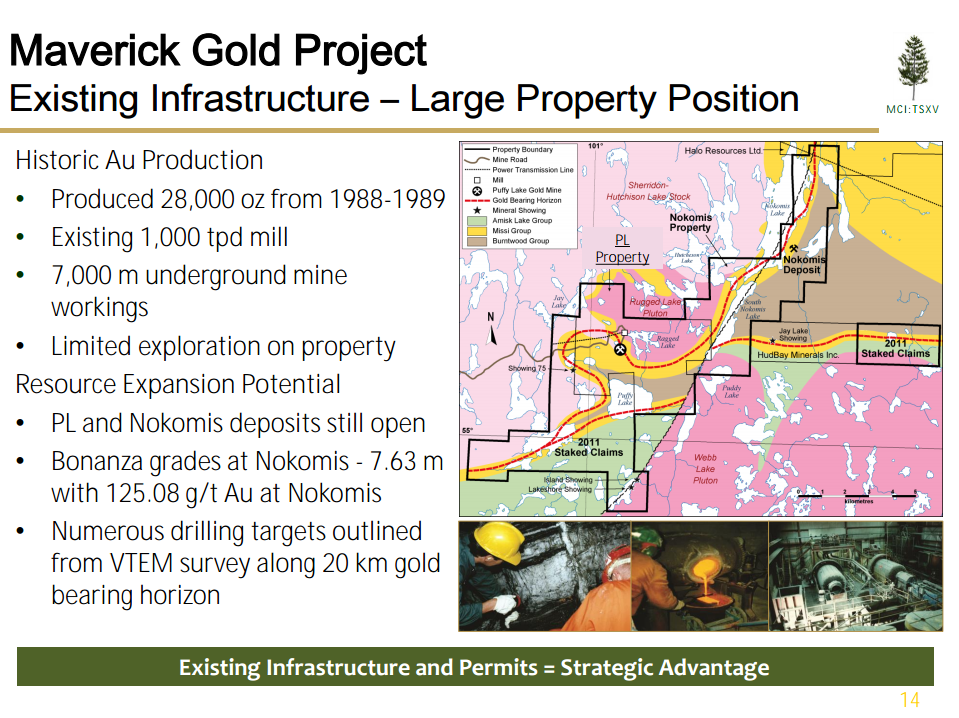

Diamond Drilling – The Company has completed phase one of its planned diamond drilling program. A total of 1,000 meters were drilled in 2 holes designed to test down dip extensions to mineralization on the Sherridon and Main Zones. Core samples have been dispatched to Accurassay of Thunder Bay and assay results will be announced when they are received.

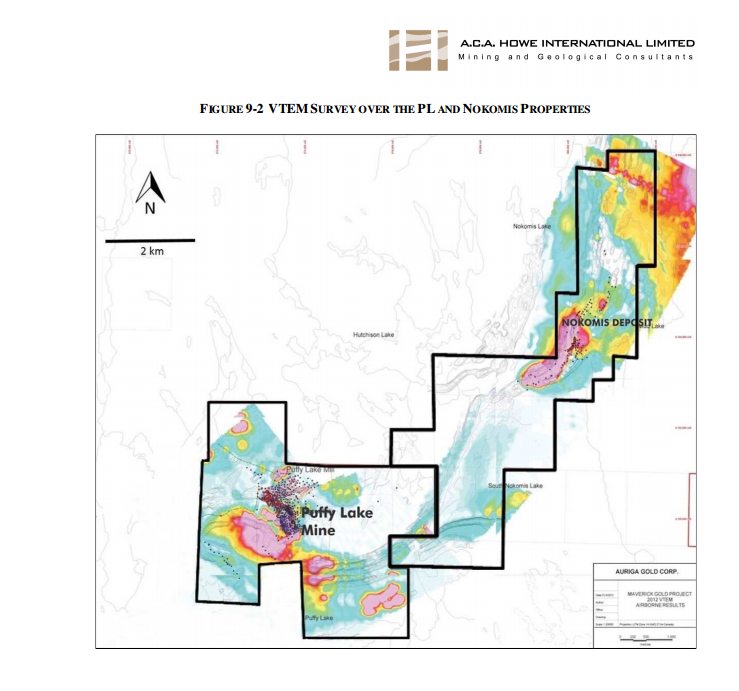

2012 VTEM Survey Follow-up – In April of 2012 Minnova reported the completion of a 66km2airborne Versatile Time Domain Electro Magnetic (“VTEM™”) and magnetic survey. Due to budgetary constraints none of the 22 identified anomalies were adequately ground truthed. As part of the 2016 field season the company has initiated a program to ground truth several of the near mine untested anomalies that show similar geophysical characteristics to the response associated with the known gold mineralization at the PL and Nokomis deposits. Field work on this initiative has generated initial positive results. For example, the original 2012 geophysical interpretation of VTEM anomaly M-05 suggested it was related to a power line that provided power to the intake pumps that supplied fresh process water to the mill during operations. Preliminary field work suggests that a portion of the 1200 meter anomaly cannot be fully attributed to the power line, which remains largely intact. A distinct portion of the anomaly measuring approximately 300 meters in length, exhibits a considerably longer wavelength and higher amplitude conductive response that is now attributed to a ground conductor response on what is interpreted to be the north west strike extension of the Sherridon Zone (the uppermost of the 5 stacked mineralized zones that make up the PL deposit). The ground conductor portion of VTEM anomaly M-05 is located 300 meters northwest of the PL mill.

Underground Mining Equipment Selection Process

As previously released the company is engaged in discussions with a number of consulting engineers and equipment suppliers to further refine the underground mine development plan for the proposed re-start of the PL Mine under our existing Environment Act License 1207E. Key requirements of the underground equipment being discussed are; a) small size, to achieve minimal mine openings and targeted narrow stope heights, b) electric power to capitalize on Manitoba’s low industrial power costs and c) proven operational performance in comparable shallow dipping-narrow vein mine settings, among other operational, maintenance and safety factors typical associated with equipment selection.

To that end we are in discussions with a number of equipment suppliers including; Aramine, Brokk AB, Dok-Ing, Dyno Nobel, RDH Mining, Sandvik and many others to review their respective Ultra-Low Profile and Extra-Low Profile (ULP/XLP) remote control equipment, specialized drilling and blasting equipment for possible application in our PL Mine re-start plan.

Gorden Glenn, CEO commented “Like Minnova, mining equipment suppliers have embraced innovation and successfully adapted many of their original equipment designs to small space underground mining situations where minimal mine openings, narrow stope widths and the use of remote control are desired. The production and remote control abilities appear to meet our corporate mandate to minimize ore dilution and enhance safety by eliminating miner exposure to unsafe working conditions”.

As our various 2016 work programs advance we will look forward to providing further updates in the near future.

Read the press release “Minnova Corp. Announces Completion of Debt Settlement and Corporate Update” here.

Timeline

Read a previous news release Minnova Corp. Announces Corporate Update” here.