Published: October 29, 2018

FETEKRO HIGHLIGHTS:

- In line with Endeavour’s objective of discovering a standalone project, exploration was launched on the Ivorian Fetekro property in 2017

- Most of the drilling to-date has focused on the Lafigué target where a first maiden resource has been delineated:

- Indicated resource of 6.8 million tonnes at 2.25 g/t Au for 494 Koz

- Inferred resource of 3.0 million tonnes at 2.25 g/t Au for 225 Koz

- The delineated resource encompasses approximately two-thirds of the total mineralized area defined to date which extends over an area 2.5 km long by 0.6 km wide

- The mineralization remains open at depth towards the southeast, east and northeast.

- 14 additional nearby targets have been identified

- Preliminary metallurgical test work suggests the potential for high gold recovery rates

- A 45,000m drilling program began in Q4-2018 and will continue in 2019, focused on the Lafigué target and testing new targets , which is expected to result in the publication of an updated resource estimate in late 2019

Abidjan, October 29, 2018 – Endeavour Mining (TSX:EDV)(OTCQX:EDVMF) is pleased to announce a maiden resource estimate on the Lafigué target, located within the Ivorian Fetekro greenfield exploration property, and the identification of 14 additional nearby targets.

Endeavour began exploration on the Fetekro property in March 2017, following a strategic assessment of its exploration tenements which ranked the property as a top priority target. Since then, nearly 32,000 meters were drilled, mainly focused on the highly prospective Lafigué target, with the drill results published on September 24, 2018.

The maiden Lafigué resource estimate, as presented in Table 1 below, encompasses approximately two-thirds of the total mineralized area defined to date which extends over an area 2.5 km long by 0.6 km wide. The mineralization remains open at depth and towards the southeast.

Table 1: Lafigué October 2018 Mineral Resource Estimate

| Tonnage | Grade | Content | |

| (Mt) | (Au g/t) | (Au koz) | |

| Indicated resources | 6.8 | 2.25 | 494 |

| Inferred resources | 3.0 | 2.25 | 225 |

Mineral Reserve estimates follow the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) definitions standards for mineral resources and reserves and have been completed in accordance with the Standards of Disclosure for Mineral Projects as defined by National Instrument 43-101. Reported tonnage and grade figures have been rounded from raw estimates to reflect the relative accuracy of the estimate. Minor variations may occur during the addition of rounded numbers. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Resources were constrained by MII Pit Shell and based on a cutoff of 0.5 g/t Au.

Based on the recently completed gold-in-soil geochemical campaign, structural mapping and ground/airborne geophysics campaigns performed, an additional 14 nearby targets have also been identified.

A 45,000-meter drill program has commenced and will continue into 2019, with a focus on the Lafigué target and testing new targets. An updated resource estimate is expected to be published in late 2019.

Sébastien de Montessus, President and CEO stated: “I would like to congratulate our exploration team for achieving this important milestone. This maiden resource brings us one step closer to attaining our strategic objective of identifying a new project as part of our 5-year exploration strategy set in late 2016.

While we have one of the largest exploration tenements in West Africa, our key strength has been the team’s ability to prioritize and rank top prospective targets to focus our efforts on those which have the best potential to one day become strategic long-life, low-cost mines within our portfolio.”

Patrick Bouisset, Executive Vice-President Exploration and Growth stated: “We are very pleased with the maiden resource as it demonstrates the prospectivity of the Fetekro property. A second exploration campaign at the Lafigué target has been launched quickly with the goal of converting the inferred resources and extending the outlined resource. The delineated Lafigué resource encompasses only approximately two-thirds of the total mineralized area defined to date and it remains open at depth, in multiple directions. Based on the initial analysis of the ore characteristics and orebody shape, we believe it could be amenable to open pit mining as mineralization starts at surface while the preliminary metallurgical test work done suggests the potential for high gold recovery rates.

Looking ahead, we are excited by the 14 additional targets identified to date, which supports our belief that Fetekro has the potential to become a new stand-alone project.”

ABOUT THE FETEKRO PROPERTY

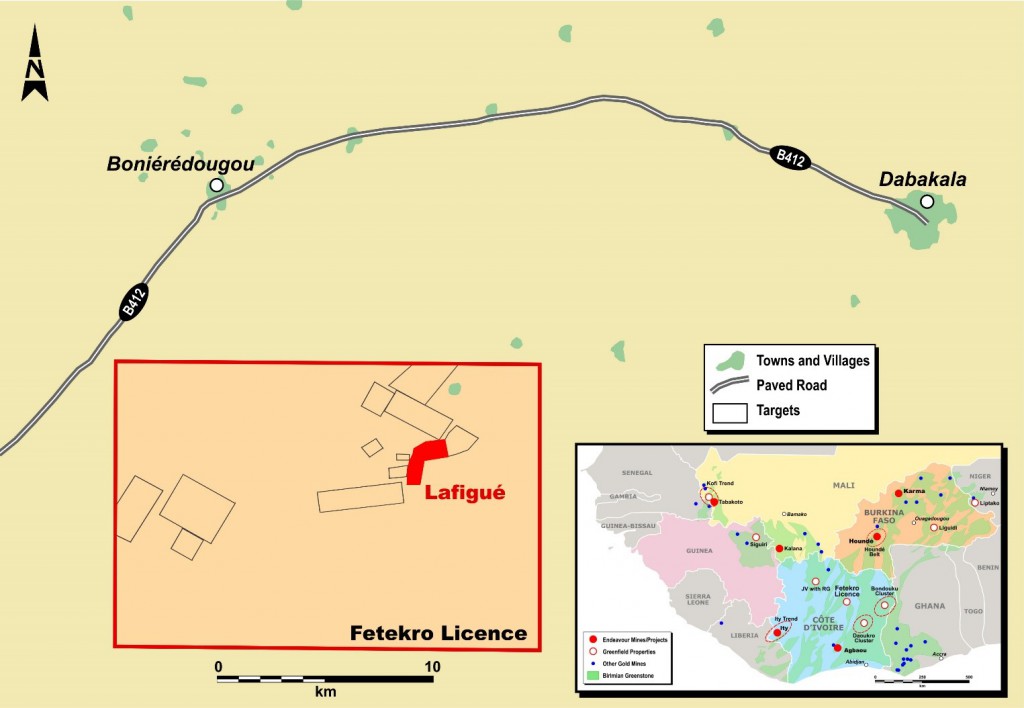

As shown in Figure 1 below, Fetekro is located in north-central Côte d’Ivoire, approximately 500km from Abidjan, within the northern-end of the Oumé-Fetekro greenstone belt.

Exploration resumed in March 2017, following the full reinterpretation of the historical data. Drilling mainly focused on the highly prospective Lafigué target where a large mineralized vein system was defined over an area 2.5km long by 0.6km wide. Additional targets were identified through the preliminary assessment of the recently completed gold-in-soil geochemical campaign. For additional information on Fetekro, including the property discription, please refer to the drill results press release issued on September 24, 2018.

ABOUT THE LAFIGUÉ TARGET: MAIN DISCOVERY TO-DATE AT FETEKRO

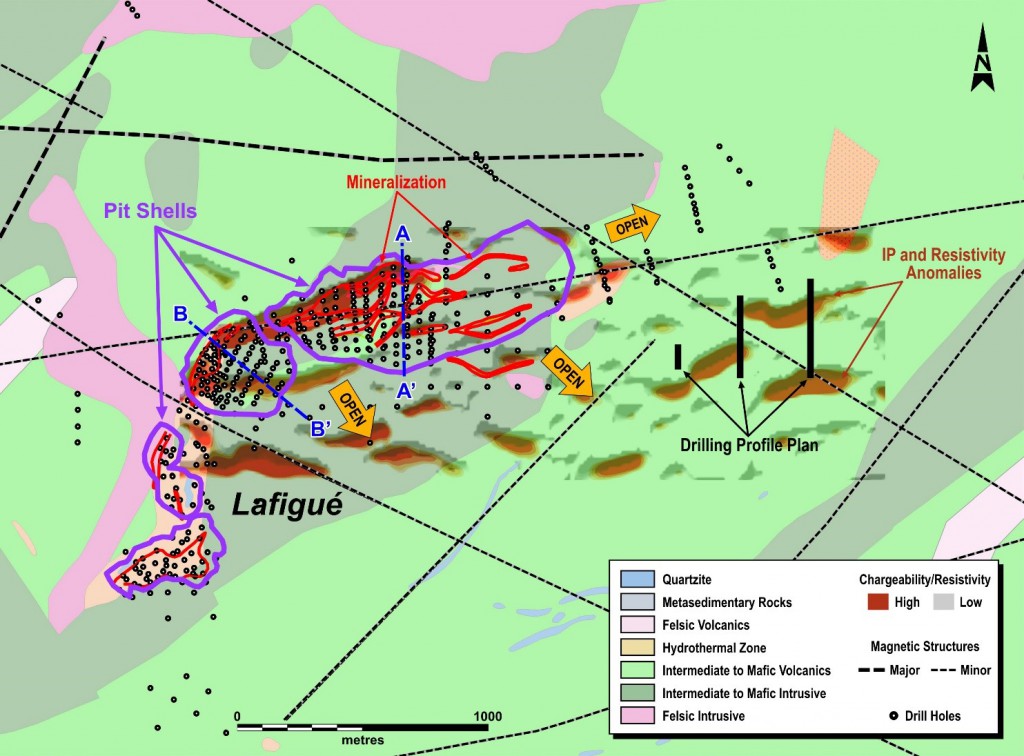

Three main mineralized zones have been identified at the Lafigué target (Lafigué South, Center, and North), with Lafigué Center and North remaining open at depth and towards the southeast, east and northeast.

The drill results, as published on September 24, 2018, suggests that the Lafigué target remains open at depth and to the southeast. In addition, the recently acquired ground geophysics (as shown in Figure 2) and geochemical data (as shown in Figure 3) also suggests that the Lafigué mineralization extends towards the east and northeast.

These potential Lafigué extensions will be tested in 2019 in conjunction with the required infill drilling program, with the aim of converting some of the known mineralized area into the resource category.

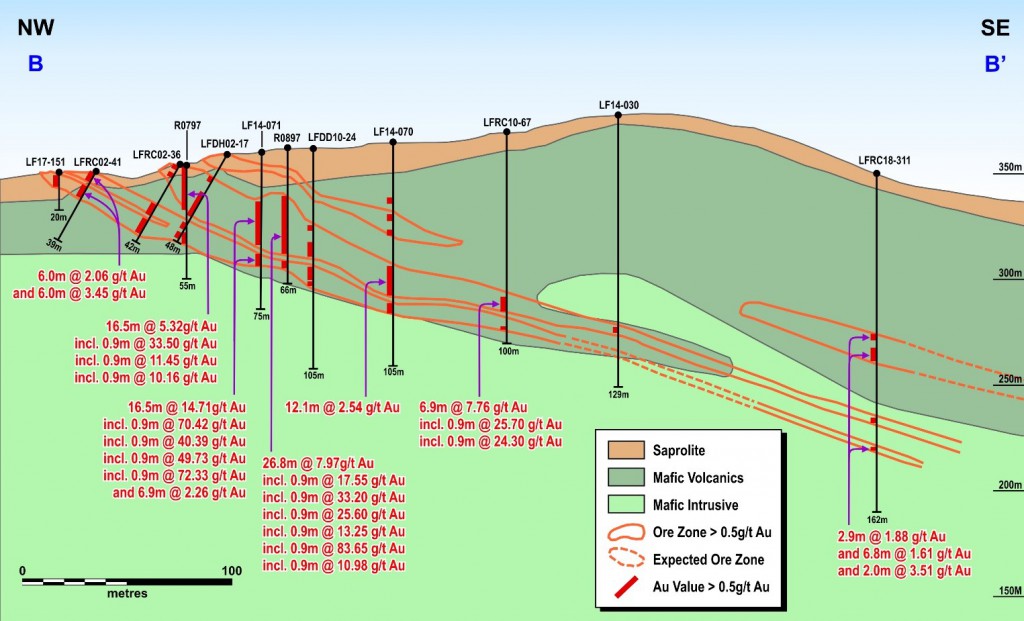

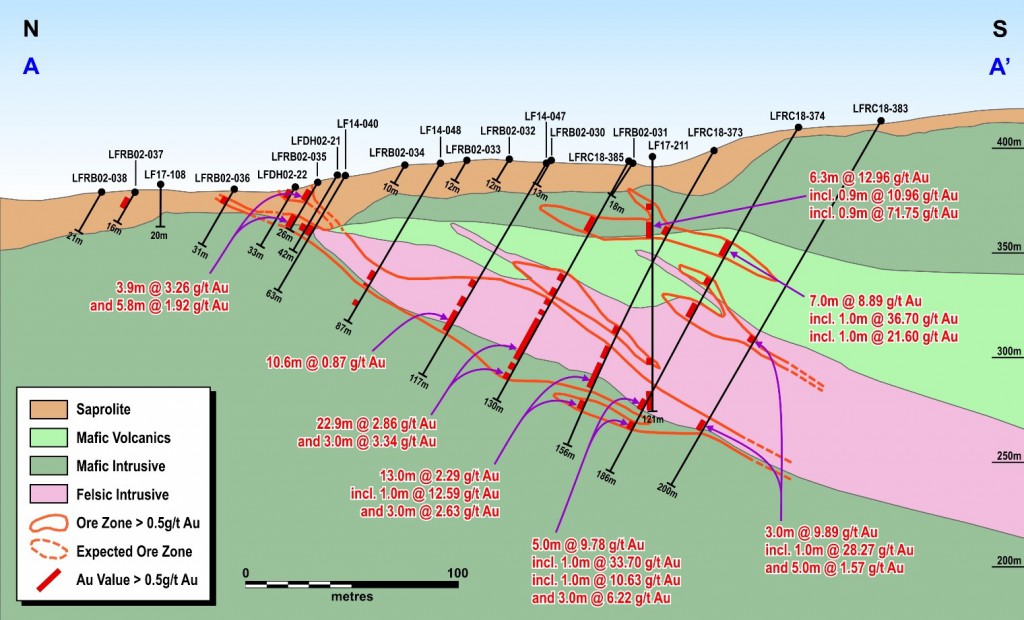

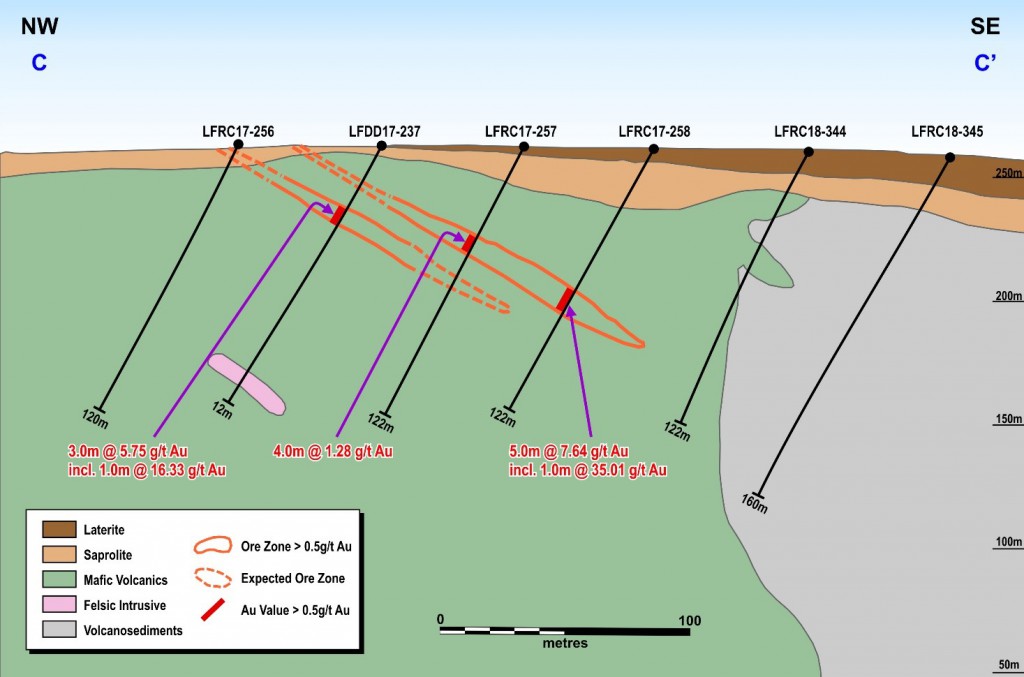

The Lafigué prospect is hosted by an east-north-east trending reverse faulting zone, which is locally bounded by two northeast-trending steep oblique-reverse shear corridors subparallel to the main Birimian structural grain. The lens-shaped mineralization of Lafigué appears to be hosted within a network of stacked and mineralized brittle-ductile reverse shear zones, dipping 20°-30° to the south-southeast. They developed mostly within the hanging-wall of a possible “basal thrust” which is either located at the contact between a mafic volcanics sequence and a mafic intrusive (as shown in the Lafigué Center cross-section in Figure 3 below) or between a mafic intrusive and a felsic intrusive (as shown in the Lafigué North cross-section in Figure 4 below).

This “basal thrust” strikes northeast to north-northeast and dips gently to the south (about 30°S). Regional schistosity varies in strike from north-south to North 070° with gentle to intermediate/steep dips to the east and south (25°-65°).

14 NEARBY TARGETS OUTLINED

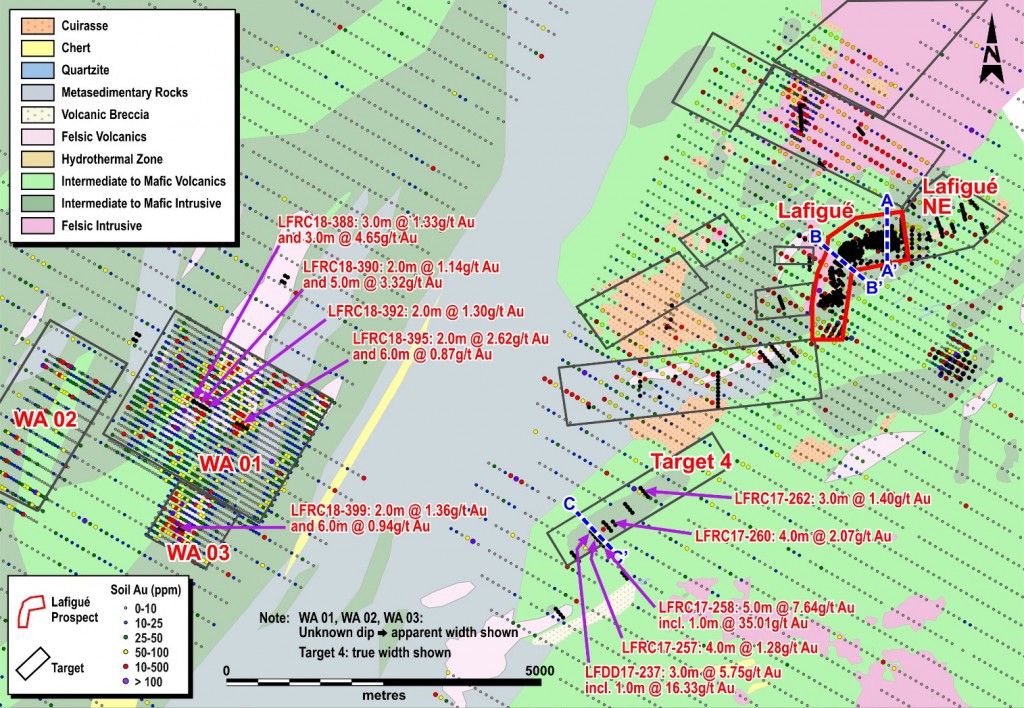

As shown in figure 5 below, the preliminary assessment of the recently acquired gold in-soil campaign coupled with VTEM, ground geophysics and geological mapping, suggest the occurrence of other mineralized systems located within a radius of 14 km around the Lafigué target.

Up to 14 targets of various extension have been identified, some of which have already recently been tested with a few Reverse Circulation (“RC”) drilling fences. Target 4, which is located 4km southwest of Lafigué, has already returned encouraging results from the fence lines drilled, as shown in Figure 6 below, which is currently being followed up with additional drilling.

The western part of the Fetekro property also appears to be highly prospective. Three large gold in soil anomalies, which may be related to the N020° shear zones hosting the regional mineralized quartz veins systems, have been identified with the few recent holes drilled. The West Anomaly (“WA”) 01, WA 02 and WA 03 anomalies cover respective areas of 6km², 1.2 km² and 4km².

Figure 5: Fetekro Gold in Soil Map and Selected Gold Intercepts over Defined Anomalies

(Apparent width for WA 01, WA 02, and WA 03; true width for Target 4)

NEXT STEPS

- A 45,000m drilling program has been launched in Q4-2018 and will continue in 2019.

- An infill drilling program has been initiated on the Lafigué target with the aim of 1) testing the extension and the contuinity of the mineralisation; and 2) converting the inferred resources into the indicated category.

- A regional exploration program is also planned in 2019 to test nearby targets with the goal of delineating a maiden resource in late 2019.

LAFIGUE RESOURCE MODELING

The statistical analysis, geological modelling and resource estimation were prepared by Kevin Harris, CPG. Mr. Harris is Endeavour Mining’s V.P. Resource Manager and a Qualified Person as defined by NI 43-101.

The Fetekro resource model was developed in Geovia’s Surpac software. A total of 11 mineralized zones were defined from the current drilling data and geologic interpretations across Lafigué South, Center, and North areas. The gold assays from the drill holes were composited to 1.0 meter intervals within the mineralized wireframes and capped at 30 g/t Au. Spatial analysis of the gold distribution within the mineralized zone using variograms indicated a good continuity of the grades along strike and down dip of the mineralized zones.

Density was measured in 406 core samples within the various rock types then averaged within the model by the weathered zones. The laterite-saprolite density is 1.81, the transition is 1.94, and the fresh rock is 2.74.

The gold grade was estimated with the inverse distance squared method constrained within the mineralized domains. The grade was estimated in multiple passes to define the higher confidence areas and extend the grade to the interpreted mineralized zone extents.

The grade estimation was validated with visual analysis and comparison with the drilling data on sections and with swath plots comparing the block grades with the composites.

The mineralized domains were classified as indicated and inferred resource classifications depending on the sample spacing, number samples, confidence in mineralized zone continuity, and geostatistical analysis. Indicated classification was generally applied to blocks within the mineralized zoned defined by a minimum of seven samples from at least three drill holes with a 45-meter search. Inferred classification is defined by a minimum of five samples within a 75-meter search from two drill holes.

The resource was constrained by a $1,500 pit shell and 0.50 g/t cutoff. The Whittle pit shell optimization assumed a base mining cost of $2.50 per tonne, mining recovery of 95%, mining dilution of 15%, pit slope of 40o, recovery of 92% in oxide and 90% in the transition and fresh rock, and processing and G&A cost of $25 per tonne.

ASSAYS AND QUALITY ASSURANCE/QUALITY CONTROL / DRILLING AND ASSAY PROCEDURES

The Reverse Circulation drill program samples were collected on a 1-meter interval using dual tube, a percussion hammer and drop centre bit. The material passes through a cyclone which is thoroughly cleaned after every sample by flushing the hole. Samples were split at the drill site using a 3-tier riffle splitter with both bulk and laboratory sample weights and moisture recorded. Representative samples for each interval were collected with a spear, sieved into chip trays and retained for reference.

Drill core (PQ, HQ and NQ size) samples are selected by LMCI geologists and sawn in half with a diamond blade at the project site. Half of the core is retained at the site for reference purposes. Sample intervals are generally 1 meter in length.

All samples are transported by road to Bureau Veritas (BV) in Abidjan (Côte d’Ivoire). Each laboratory sample is secured in poly-woven bags ensuring that there is a clear record of the chain of custody. On arrival samples are weighed and crushed to 2mm (70% passing), pulverize entire sample to 75 micrometers (85% passing). Samples are analyzed for gold using standard fire assay technique with a 50-gram charge and an Atomic Absorption (AA) finish. Blanks, field duplicates and certified reference material (CRM’s) are inserted by LMCI geologists in the sample sequence for quality control and to ensure there are a suite of QC samples in each fire assay batch.

The sampling and assaying at Lafigué is monitored through the implementation of a quality assurance – quality control (QA-QC) program. This QA-QC program was audited by International mining consultant in 2017 and consequently designed to follow industry best practices.

QUALIFIED PERSONS

The scientific and technical content of this news release has been reviewed, verified and compiled by Gérard de Hert, EurGeol, Senior VP Exploration for Endeavour Mining. Gérard de Hert has more than 20 years of mineral exploration and mining experience and is a “Qualified Person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). The resource estimation was completed by Kevin Harris, CPG, VP Resources for Endeavour Mining and “Qualified Person” as defined by National Instrument 43-101.

CONTACT INFORMATION

| Martino De Ciccio VP – Strategy & Investor Relations +44 203 640 8665 mdeciccio@endeavourmining.com |

Brunswick Group LLP in London Carole Cable, Partner +44 7974 982 458 ccable@brunswickgroup.com |

ABOUT ENDEAVOUR MINING CORPORATION

Endeavour Mining is a TSX listed intermediate African gold producer with a solid track record of operational excellence, project development and exploration in the highly prospective Birimian greenstone belt in West Africa. Endeavour is focused on offering both near-term and long-term growth opportunities with its project pipeline and its exploration strategy, while generating immediate cash flow from its operations.

Endeavour operates 5 mines across Côte d’Ivoire (Agbaou and Ity), Burkina Faso (Houndé, Karma), and Mali (Tabakoto) which are expected to produce 670-720koz in 2018 at an AISC of $840-890/oz. Endeavour’s high-quality development projects (recently commissioned Houndé, Ity CIL and Kalana) have the combined potential to deliver an additional 600koz per year at an AISC well below $700/oz between 2018 and 2020. In addition, its exploration program aims to discover 10-15Moz of gold between 2017 and 2021 which represents more than twice the reserve depletion during the period.

For more information, please visit www.endeavourmining.com .

Corporate Office: 5 Young St, Kensington, London W8 5EH, UK

This news release contains “forward-looking statements” including but not limited to, statements with respect to Endeavour’s plans and operating performance, the estimation of mineral reserves and resources, the timing and amount of estimated future production, costs of future production, future capital expenditures, and the success of exploration activities. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “expects”, “expected”, “budgeted”, “forecasts”, and “anticipates”. Forward-looking statements, while based on management’s best estimates and assumptions, are subject to risks and uncertainties that may cause actual results to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to the successful integration of acquisitions; risks related to international operations; risks related to general economic conditions and credit availability, actual results of current exploration activities, unanticipated reclamation expenses; changes in project parameters as plans continue to be refined; fluctuations in prices of metals including gold; fluctuations in foreign currency exchange rates, increases in market prices of mining consumables, possible variations in ore reserves, grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes, title disputes, claims and limitations on insurance coverage and other risks of the mining industry; delays in the completion of development or construction activities, changes in national and local government regulation of mining operations, tax rules and regulations, and political and economic developments in countries in which Endeavour operates. Although Endeavour has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Please refer to Endeavour’s most recent Annual Information Form filed under its profile at www.sedar.com for further information respecting the risks affecting Endeavour and its business. AISC, all-in sustaining costs at the mine level, cash costs, operating EBITDA, all-in sustaining margin, free cash flow, net free cash flow, free cash flow per share, net debt, and adjusted earnings are non-GAAP financial performance measures with no standard meaning under IFRS, further discussed in the section Non-GAAP Measures in the most recently filed Management Discussion and Analysis.

For the full press release click here.