Rick Mazur, Alto Ventures CEO and Director commented, “With the recently announced sale of the Coldstream Property by Canoe to Wesdome Gold Mines Ltd and potential development of the Moss Lake gold deposit, Alto Ventures shareholders stand to benefit from potential future production on the property through the NSR royalties granted to Alto Ventures.”

Alto is also pleased to provide an update on its key gold exploration activities in Quebec, Manitoba and Ontario.

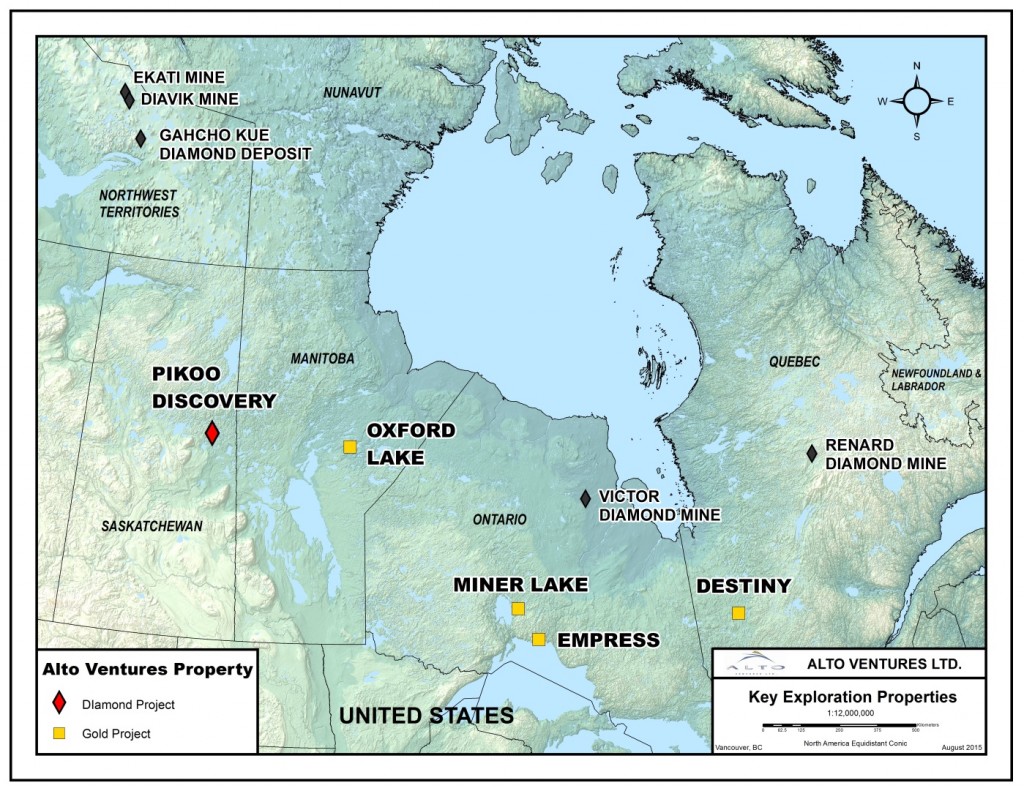

Destiny, Quebec

The Destiny Property is 100% owned by Alto Ventures and located in the Abitibi greenstone belt, approximately 100 road km north of Val d’Or. The property hosts one gold deposit (DAC Deposit) and several other significant gold zones that require further drilling. Resource estimates were prepared for the DAC Deposit in compliance with NI43-101* standards in January 2011 and include 10.8 million tonnes at an average grade of 1.05 g/t Au in the Indicated (364,000 ounces) plus 8.3 million tonnes averaging 0.92 /t Au in the Inferred (247,000 ounces) categories at a cut-off grade at 0.5 g/t Au (*NI43-101 Technical Report and Resource Estimation of the DAC Deposit, Destiny Property, Quebec; March, 2011 by Todd McCracken, P. Geo.). The DAC Deposit is open to depth and on strike to the east where it extends into the Gap and Darla Zones.

Drilling in 2012 tested a one kilometer segment (Gap Zone) of the Despinassy Shear Zone immediately east of the DAC Deposit. The drill holes were spaced 100 m apart and each hole intersected gold mineralization but the density of drilling is still insufficient for completion of an NI43-101 resource estimate for the Gap Zone. Significant gold intersections include hole DES12-147 with high grade values up to 78.7 g/t gold over 1.0 m within a wider mineralized envelope averaging 11.3 g/t gold over 8.0 m. Wider zones with gold grades similar to the DAC deposit average were intersected in some holes including 1.05 g/t gold over 10.0 m and 1.04 g/t gold over 11.0 m, both from hole DES12-144.

Higher grade intercepts in the Darla Zone, located immediately east of the Gap Zone include 19.5 g/t gold over 2.1 m and 20.6 g/t gold over 0.8 m within strongly altered rocks that are similar to those hosting the gold zones at the DAC Deposit.

The Company is planning a 3,000 m Stage 1 diamond drilling program to in-fill the Gap Zone to confirm continuity of mineralization and advance the project towards the preparation of an updated Resource Estimate Report to include the Gap Zone with the DAC Deposit.

Miner Lake, Ontario

The Miner Lake Property lies in the Beardmore-Geraldton gold belt approximately 60 km west northwest of the Town of Geraldton. The property is road accessible year-round but has received only limited exploration in the past. Surface Exploration work has identified numerous hydrothermal breccia zones that contain significant gold mineralization within an intermediate intrusive body. Some of the assays results from surface saw-cut channel sampling include a 19 m wide zone averaging 1.78 g/t gold and 0.11 % copper. This zone contains two higher-grade sections, one averaging 3.36 g/t gold and 0.24% copper across 5.0 m and another averaging 6.29 g/t gold and 0.08% copper across 2.0m. Diamond drilling completed in 2011 intersected gold in eight of the nine holes drilled, including a 39.2 m intercept averaging 0.6 g/t gold. There are numerous other breccia targets on the property that require drilling.

Results from a glacial till sampling program completed in 2015 detected several gold-in-till anomalies including five samples that contain over 100 gold grains each, most of which are described as pristine grains. The distribution of the gold-in-till anomalies suggests possible new gold occurrences on the property not yet discovered.

Exploration plans for this summer include additional glacial till sampling to better define the gold-in-till anomalies from 2015. Geological mapping and prospecting programs will also be carried out coincident with the till sampling. Because of the easy access diamond drilling can be completed later this year.

Oxford Lake, Manitoba

Oxford Lake gold property is located in central Manitoba, approximately 150 km southeast of Thompson. The property hosts the historical Rusty Gold Deposit with reported Historical Resources of 800,000 tonnes averaging 6 g/t gold (containing approximately 154,000 ounces of gold) estimated to a depth of 600 metres. The Historical Resources were estimated in 1990 and a Qualified Person (QP), as defined by NI43-101, has not done sufficient work to classify this historical estimate as current mineral resources. Alto is not treating the historical estimate as current mineral resources, as defined by NI43-101, and thus the historical estimate should not be relied upon.

The property hosts several other gold occurrences including the Blue Jay Zone. Diamond Drilling in 2012 of hole RUS12-03 to test the Blue Jay Zone 2.2 km east of the Rusty Deposit intersected two zones of gold mineralization; Zone One averages 6.7 grams/tonnes gold over 2.7 m core length including 22.5 g/t over 0.5 m and Zone two averages 5.7 g/t gold over 6.8 m core length including 11.7 g/t gold over 1.6 m and 16.5 g/t gold over 1.0 m.

Gold mineralization at the Rusty Deposit and the Blue Jay Zone is associated with weakly sulphidized banded magnetite iron formation that can be followed by airborne geophysical surveys. The geophysical trend that hosts these gold zones has been traced by the VTEM and aeromagnetic surveys completed by Alto Ventures in 2011 for 30 km along strike but only a few holes were drilled in the past along this trend.

Alto’s President, Mike Koziol, P. Geo. has reviewed field procedures, technical data, and conclusions described in this news release. He is a qualified person under the provisions of National Instrument 43-101 and approves the technical data and conclusions in this news release.

Read about the gold project news release here.